Who Lends to Households and Firms?

The financial sector in the U.S. economy is deeply interconnected. In our previous post, we showed that incorporating information about this network of financial claims leads to a substantial reassessment of which financial sectors are ultimately financing the lending to the real sector as a whole (households plus nonfinancial firms). In this post, we delve deeper into the differences between the composition of lending to households and nonfinancial firms in terms of direct lending as well as the patterns of “adjusted lending” that we compute by accounting for the network of claims financial subsectors have on each other.

Author Brief

“Our study focuses on trying to understand whether who the lender is matters for future real outcomes following credit booms.”

-Nina Boyarchenko, coauthor

Direct Lending to Households and to Nonfinancial Firms

As in our previous post, we start by exploring how the composition of lending to the real sector has evolved over time with a focus on the differences between lending to households and lending to nonfinancial firms.

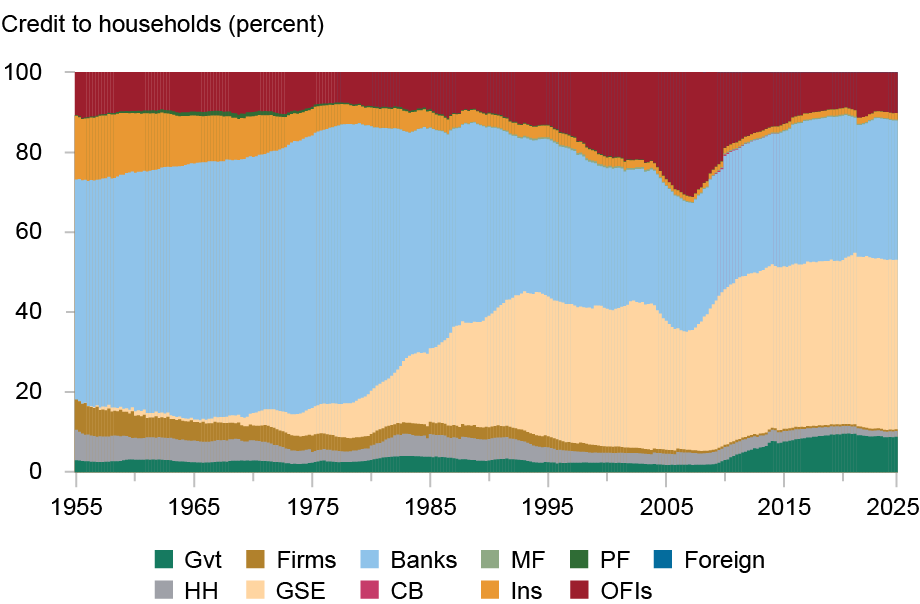

The chart below plots the shares of lending to the household sector. The chart highlights the growing importance of government-sponsored enterprises (GSEs) and the corresponding decrease in shares of lending by banks. While banks accounted for over 50 percent of direct lending to households at the beginning of our sample (1955), that share has decreased to around 30 percent. Direct lending by banks has been replaced largely by lending by GSEs. As the chart below shows, this substitution started in the 1970s, accelerated around 1980, and stabilized following the global financial crisis (GFC).

The Importance of Banks as a Lender to the Household Sector Has Declined over Time

Notes: The chart shows direct credit to the household sector by lender sector, in percentages. “Gvt” refers to the government sector, “firms” to nonfinancial business, “banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

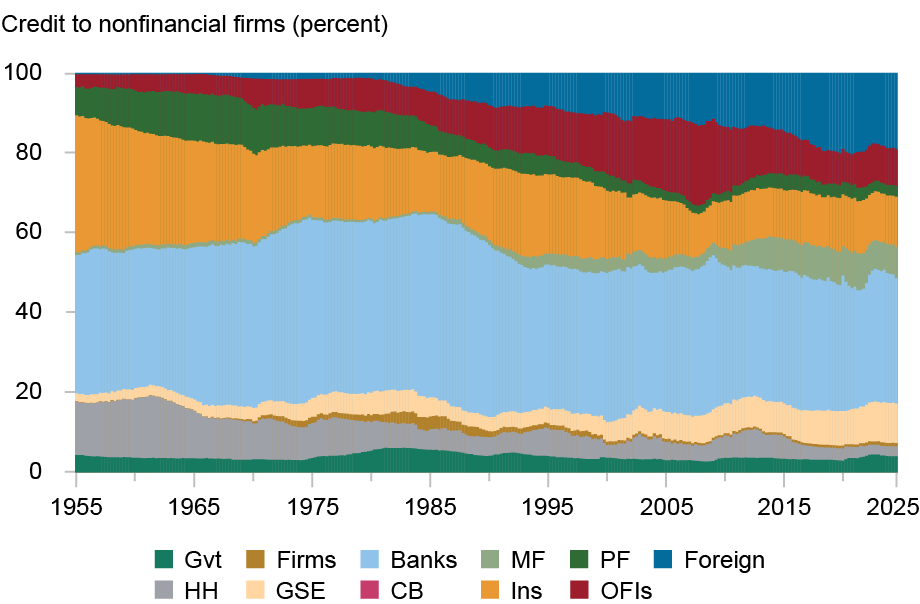

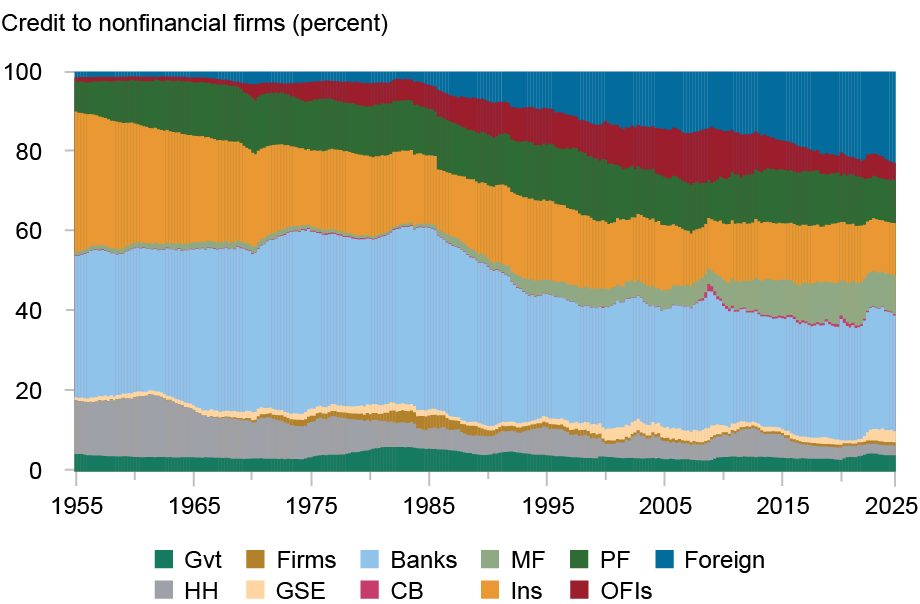

Turning to lending to nonfinancial firms, the chart below shows a drastically different time-series pattern. While banks have never been as dominant a player in lending to firms as they are in lending to households (they accounted for around 30 percent at the beginning of the sample), their share has remained relatively stable over time. That is, we do not observe the large contraction in the share of lending by banks that we observe in the share of lending by banks to households.

Instead, we observe substitution away from lending by insurance companies and pension funds. While these two sectors accounted for around 40 percent of total lending to nonfinancial firms in 1955, their share has declined to around 20 percent in the last seventy years. This decrease has been picked up largely by the foreign sector. Other financial institutions (OFIs) increased their market share leading up to the GFC but have since declined in importance. GSEs and mutual funds have also seen an increase in their market share.

The Importance of the Foreign Sector as a Lender to Nonfinancial Firms Has Grown

Notes: The chart shows direct credit to nonfinancial firms by lender sector, in percentages. “Gvt” refers to the government sector, “firms” to nonfinancial business, “banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

Adjusted Lending to Households and Firms

In our previous post, we showed how using information on the network of intrafinancial sector claims can be used to compute “adjusted lending” by each financial sector. That is, the lending by a sector that accounts for both its direct lending but also lending that occurs through other intermediaries. In this section we show adjusted lending to households and firms and discuss how it differs from the patterns of direct lending discussed above.

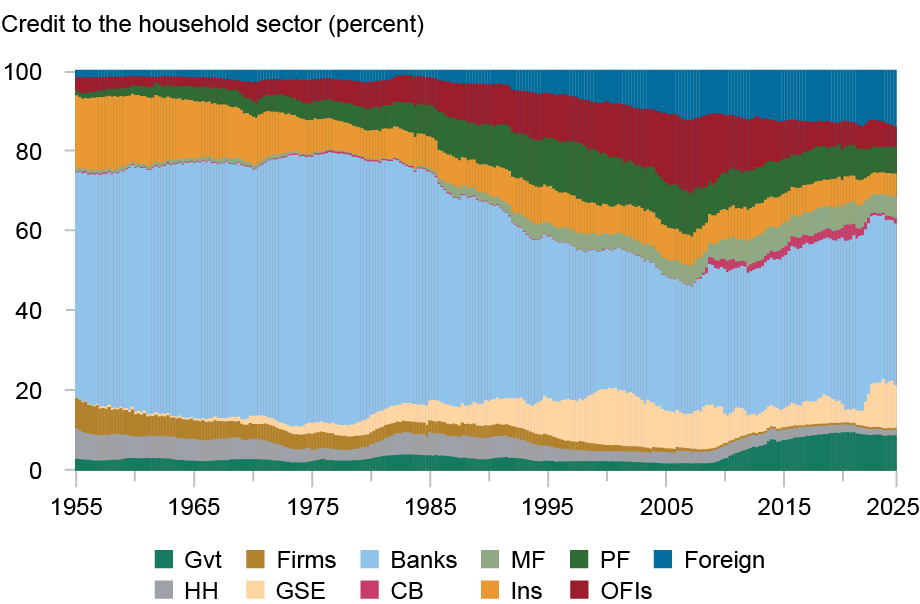

Starting with adjusted lending to households, the chart below shows a much smaller increase in lending by GSEs and a corresponding smaller decline in lending by banks than what direct lending would suggest (see the first chart of this post). This is explained by the fact that banks lend to households “through GSEs.”

It is also worth noting the increase in importance of the foreign sector and of pension funds in terms of adjusted lending. This suggests that both the foreign sector and pension funds have been increasing their share in this market by providing lending to households through other domestic financial sectors.

GSEs Lending to Households Is Largely Financed by Other Financial Sectors

Notes: The chart shows adjusted credit to the household sector by lender sector, in percentages. “Gvt” refers to the government sector, “firms” to nonfinancial business, “banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

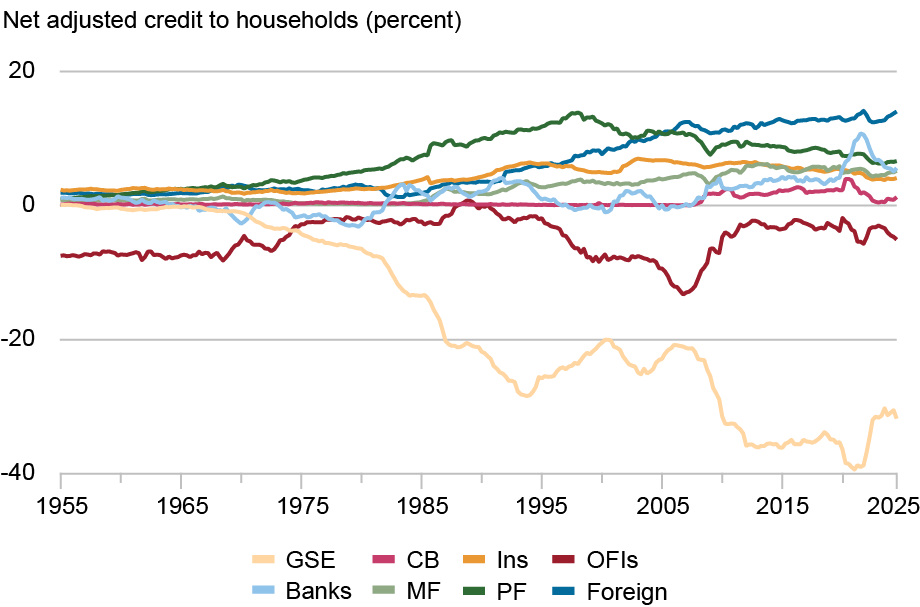

To more easily compare shares of adjusted lending versus shares of direct lending, the chart below plots the difference between the two shares for each sector (negative values indicate that shares of adjusted lending are smaller than direct lending shares). The chart confirms the discussion above, the share of lending to households by GSEs dramatically decreases once we account for the fact that they are, to a large extent, simply intermediating bank lending to households.

Adjusted Lending to Households Is Substantially Lower for GSEs and Higher for the Foreign Sector than Their Direct Lending

Notes: The chart shows net adjusted credit to the household sector by financial sector, in percentages. “Banks” refers to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “foreign” to the rest of the world, “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

.

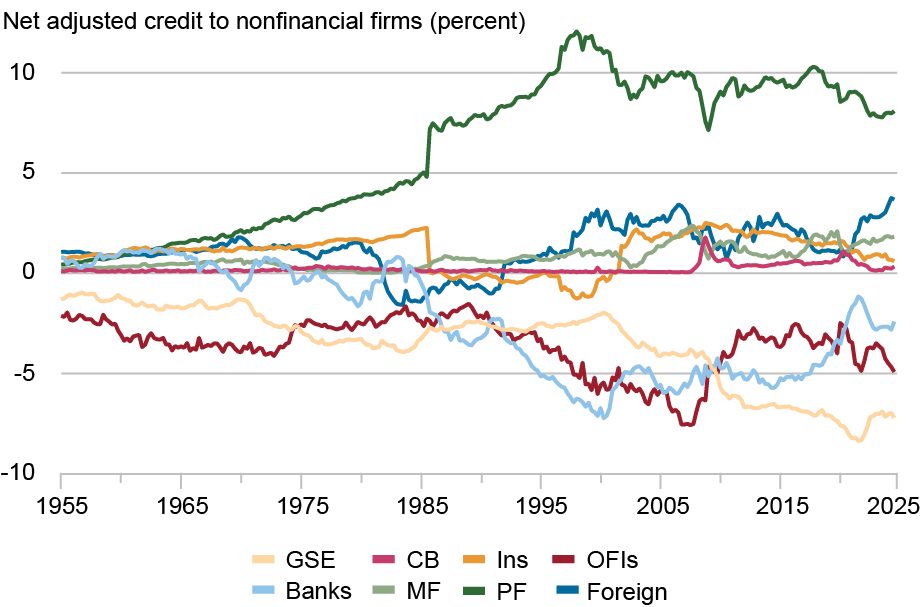

We then turn to adjusted lending to nonfinancial firms. The chart below shows the shares of adjusted lending by each sector are relatively similar to the shares of direct lending observed in the second chart of this post. This suggests that “indirect lending” through other financial intermediaries is less prevalent in lending to nonfinancial firms than it is in lending to households (at least on net). This finding is consistent with the view that firms can more easily raise funds directly from their ultimate lenders while household borrowing requires more intermediation.

While the differences between direct and adjusted lending to firms are less pronounced, two results are worth noting. First, unlike the case of household lending, banks’ share of lending on an adjusted basis is lower than their share of direct lending. This suggests that banks are intermediating lending by other parts of the financial system to households.

Second, the largest reallocation we observe is by pension funds, who seem to be, rather than lending directly to firms, lending indirectly by financing sectors that then lend to firms.

Pension Funds Still Finance a Substantial Fraction of Indirect Lending to Firms

Notes: The chart shows adjusted credit to nonfinancial firms by lender sector, in percentages. “Gvt” refers to the government sector, “firms” to nonfinancial business, “banks” to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “foreign” to the rest of the world, “HH” to households (and nonprofit institutions serving households), “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

As in the case of household lending discussed above, plotting “net adjusted lending” allows us to more easily compare the differences between adjusted and direct lending. The negative values for GSEs, OFIs, and banks indicate that they are, to some extent, intermediating other sectors’ lending to firms. On the other hand, the positive values for the foreign sector and, more importantly, for pension funds, indicate that they lend more to firms than what their direct lending would suggest. That is, the foreign sector and pension funds rely on other sectors to intermediate their lending to firms.

Adjusted Lending to Firms Is Larger for Pension Funds and Lower for GSEs, OFIs, and Banks than Their Direct Lending

Notes: The chart shows net adjusted credit to the household sector by financial sector, in percentages. “Banks” refers to monetary financial institutions, “MF” to mutual funds, “PF” to pension funds, “foreign” to the rest of the world, “GSE” to government-sponsored enterprises, “CB” to the central bank, “Ins” to insurance companies, and “OFIs” to other financial institutions.

Wrapping Up

The financial sector in the U.S. economy is deeply interconnected. Incorporating information about this network of financial claims leads to a substantial reallocation of the accounting of lending to the real sector but it has different implications for household credit and corporate credit, suggesting that the need for intermediation is different in these two markets.

In a previous post, as well as in our staff report, we document that who finances a credit boom to the real sector is an important determinant of future macroeconomic outcomes. The results in this post suggest that one potential channel for why bank and nonbank expansions in credit lead to different outcomes is the underlying network of financial interconnections that is ultimately lending to households and firms.

Nina Boyarchenko is a financial research advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Leonardo Elias is a financial research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Nina Boyarchenko and Leonardo Elias, “Who Lends to Households and Firms?,” Federal Reserve Bank of New York Liberty Street Economics, July 14, 2025, https://libertystreeteconomics.newyorkfed.org/2025/07/who-lends-to-households-and-firms/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).