The Emergence of Tokenized Investment Funds and Their Use Cases

A blockchain is a distributed database where independent computers across the world maintain identical copies of a transaction record, updating it only when the network reaches consensus on new transactions—making the history transparent and extraordinarily difficult to alter. Historically, bonds have traded almost entirely in over-the-counter (OTC) markets, while equities and money market fund shares have largely settled through centralized infrastructures such as stock exchanges and central securities depositories. In both settings, each institution maintains its own records, and post-trade steps like confirmation, clearing, and settlement require multiple intermediaries and repeated reconciliation.

Blockchain offers a different model: instead of fragmented books or a single central authority, all participants share a single, consensus-validated ledger of ownership and transactions. A tokenized asset—whether a bond, equity, or money market fund share—is a digital representation of that claim on the blockchain, with transfers recorded as direct updates to this shared ledger. While distributed ledgers are not inherently faster or cheaper than centralized systems, they differ in important ways: no single entity controls the record; programmable logic can automate corporate actions or enforce transfer restrictions; and auditability is native through an append-only history.

In this way, blockchain replaces bilateral and centrally governed recordkeeping with a common ledger that is jointly maintained and verifiable in real time. While many types of assets have been tokenized to date, we focus on the tokenization of “money-like” investment funds that potentially allow for novel use cases. We provide a background of how these products have evolved and discuss their use cases. In a subsequent post, we examine the benefits and risks to financial stability from these products.

Background

Many types of assets have been tokenized to date, including real estate, commodities, agriculture, and other financial securities. But the bulk of tokenization activity in the United States has concentrated on two types of funds: money market funds (MMFs), which are open-end funds registered under the Investment Company Act of 1940 (1940 Act), and private funds that are exempt from registration under that Act. Several private funds have been proposed by large financial institutions, suggesting surging interest among market participants and the possibility of wider adoption.

Private funds are exempt from many of the requirements in federal securities laws and regulations applicable to MMFs, including the 1940 Act’s disclosure requirements for investment companies. As a result, regulators and the public have little visibility into their operations, including whether they have instituted the same type of liquidity risk management tools as MMFs are required to implement (for example, portfolio maturity maximums and liquid asset minimums).

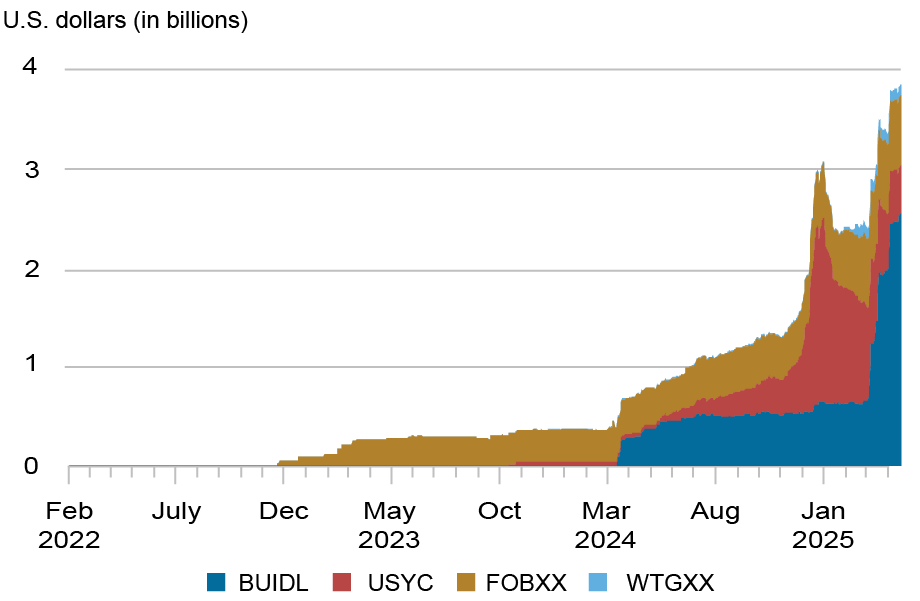

Three prominent tokenized MMFs are Franklin Templeton’s FOBXX (AUM $708M), Circle/Hashnote’s USYC ($488M) and WisdomTree’s WTGXX ($10.8M); the largest tokenized private fund is BlackRock’s BUIDL (AUM $2.5B). The chart below shows the growth of these four tokenized funds.

Total Assets Under Management of Select Tokenized Funds

Use Cases

Three prominent use cases of tokenized funds have been developed to date, all of which are novel as they have historically not been available to investment funds due to numerous legal, regulatory, and/or market reasons. See, for example, “Lessons from the History of the U.S. Regulatory Perimeter” for how the legal perimeter has evolved in the United States, separating deposit liabilities, which are considered legal payment instruments, from other types such as investment funds’ liabilities, which are not.

Use Case I: Development of a Secondary Market and Instantaneous Liquidity Pools

Investors may want to hold tokenized shares beyond their traditional function as a store of value. For example, tokenization allows shares to circulate as a medium of exchange in secondary markets. Such a possibility would be facilitated by innovative efforts to offer immediate liquidity against tokenized shares. For instance, some fund issuers have established processes by which their tokenized shares can be exchanged for more widely used means of digital-asset payments, namely stablecoins. A prominent example is the smart-contract-controlled pool where BUIDL and FOBXX are instantaneously exchangeable for USDC, the second-biggest stablecoin by market capitalization. These initiatives enable a deeper integration of tokenized funds with the digital-asset ecosystem, thereby increasing benefits to investors of tokenized funds, as they can use their shares to transact in ways historically unavailable to such shares.

Use Case II: Reserve Asset for DeFi-based Products

Tokenization can also facilitate the use of the shares to be used as a store of value in the digital-asset ecosystem. For example, at least three DeFi-based products use BUIDL as a reserve asset. One such product is Ondo Finance’s “Short-Term U.S. Government Treasuries” (OUSG). Recently, Ondo announced it would exchange shares of OUSG for shares in four tokenized MMFs (FOBXX, WTGXX, and two international funds). Ondo plans to then hold the acquired shares as part of OUSG’s reserve assets which are predominantly made up of BUIDL. In essence, OUSG serves as an example of the secondary market functionality discussed above with an increased role for tokenized shares to be a store of value in the digital-asset ecosystem, while also providing additional liquidity for token holders given the 24/7 on-off ramp in which tokenized funds can be indirectly exchanged for stablecoins. While Ondo could have used stablecoins as collateral directly, this would have been less attractive as a store of value since stablecoins do not pay interest. In addition, both Mountain Protocol’s stablecoin and the rebranded FRAX stablecoin claim that BUIDL comprises a portion of their reserve assets.

Use Case III: Collateral for Derivatives

A third use case for tokenized shares is posting margins for repurchase agreements and derivatives transactions. Bloomberg reports that two of the world’s largest crypto prime brokers allow clients, including hedge funds, to use BlackRock’s BUIDL as collateral for crypto-based derivatives trading and are in early talks with some of the world’s largest crypto exchanges to expand this offering. Moreover, Circle recently purchased Hashnote, the issuer of the world’s largest tokenized MMF to “emerge as a preferred form of yield-bearing collateral on crypto exchanges, and also with custodians and prime brokers.” Meanwhile, in traditional derivatives, JPMorgan Chase facilitated a transaction in which tokenized BlackRock MMF shares were pledged as collateral with Barclays for a derivatives contract, although there haven’t been any additional transactions to date.

Final Words

It is too early to tell what impact, if any, tokenized shares will have on the financial system. Thus far tokenized shares have been mainly facilitating use cases within the digital-asset ecosystem. While there exists a lot of opacity in how these tokenized funds are being used as well as limited evidence of broader acceptance so far, interconnections between the traditional financial system and digital assets could increase if these products are used more broadly by market participants in the future.

Pablo Azar is a financial research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

Francesca Carapella is a principal economist in the Macroprudential Policy Analysis Section at the Federal Reserve Board.

JP Perez-Sangimino is a senior policy analyst in Innovation Policy at the Federal Reserve Board.

Nathan Swem is a principal economist in the Financial Stability Assessment Section at the Federal Reserve Board.

Alexandros P. Vardoulakis is chief of the Macroprudential Policy Analysis Section at the Federal Reserve Board.

How to cite this post:

Pablo Azar, Francesca Carapella, JP Perez-Sangimino, Nathan Swem, and Alexandros P. Vardoulakis, “The Emergence of Tokenized Investment Funds and Their Use Cases,” Federal Reserve Bank of New York Liberty Street Economics, September 24, 2025, https://doi.org/10.59576/lse.20250924a

BibTeX: View |

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).