Financial Intermediaries and the Changing Risk Sensitivity of Global Liquidity Flows

Global risk conditions, along with monetary policy in major advanced economies, have historically been major drivers of cross-border capital flows and the global financial cycle. So what happens to these flows when risk sentiment changes? In this post, we examine how the sensitivity to risk of global financial flows changed following the global financial crisis (GFC). We find that while the risk sensitivity of cross-border bank loans (CBL) was lower following the GFC, that of international debt securities (IDS) remained the same as before the GFC. Moreover, the changes in risk sensitivities of these flows were related to balance sheet constraints of financial institutions that were intermediating these flows.

Time Variation in the Risk Sensitivity of Global Liquidity Flows

Following the GFC, the composition of aggregate global liquidity (AGL)—defined as the sum of CBL and IDS—changed considerably. Riskier borrowers migrated from CBL to IDS markets, likely driven by changes in bank regulation after the GFC. In particular, global banks became more tightly regulated, increasing their risk-absorbing capacity while also raising their balance sheet cost of providing risky loans. Concurrently, nonbank financial institutions (NBFIs) increased their credit intermediation, particularly in IDS markets.

How did these changes affect the risk sensitivity of AGL after the GFC? In Avdjiev, Gambacorta, Goldberg, and Schiaffi (2025), we find a marked decline in the magnitude of the global liquidity response to adverse risk conditions relative to earlier patterns. We further show that global liquidity flows depend on the characteristics of the financial institutions intermediating them as well as on the composition of flows (in other words, CBL versus IDS).

Our empirical investigation uses quarterly data (from Q1:2000 to Q1:2024) for sixty-one borrowing countries that are split into two groups: “other advanced economies” (OAE), excluding countries viewed as safe havens, and emerging market economies (EMEs). We also distinguish between borrower sectors (bank and nonbank). As measures of risk, we use the Chicago Board Options Exchange’s CBOE Volatility Index, or VIX, a well-known index that indicates market expectations of stock price volatility.

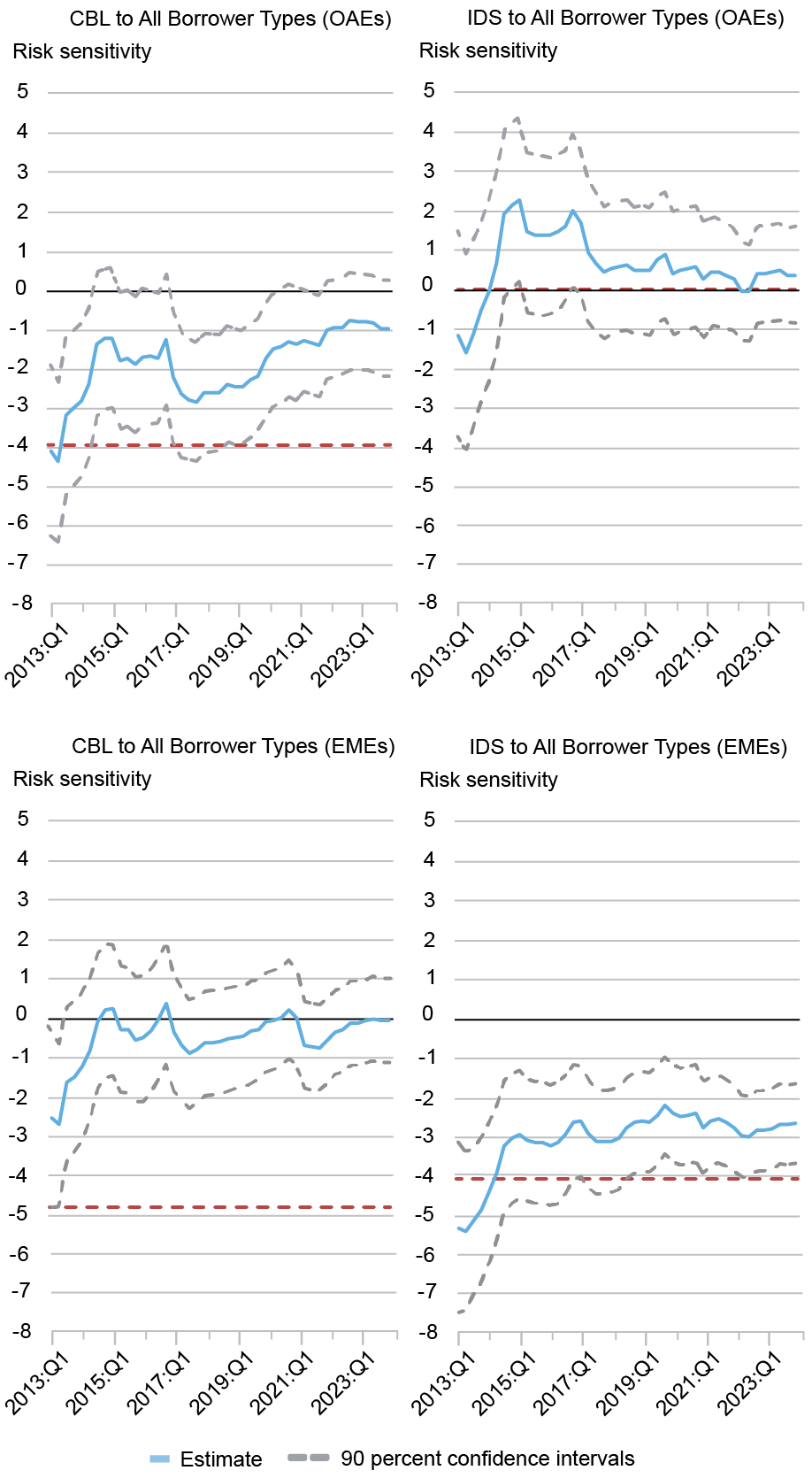

We document extensive time variation in the risk sensitivities of AGL and its main components, from the perspective of borrowers. The evolution of the global risk sensitivities displays considerable heterogeneity across several dimensions, such as flow type, borrowing country, and borrowing sector, as shown in the chart below. The sensitivity of CBL to global risk was significantly negative before the GFC but became statistically insignificant after the GFC, suggesting a decline in its risk sensitivity. The global risk sensitivity of IDS issued by OAE residents (upper right panel) was insignificant throughout the entire period we examine. In contrast, the global risk sensitivity of IDS issued by EME borrowers (lower right panel) declined slightly but remained considerably elevated.

Post-GFC Evolution of Risk Sensitivity Compared with Pre-GFC

Notes: For each quarter t, the four panels of the chart show the evolution in the risk sensitivity since 2009:Q1 (and its 90 percent confidence interval), using the Chicago Board Options Exchange’s CBOE Volatility Index (VIX) as the measure of risk obtained by estimating the model with a sample from 2000:Q1 up to quarter t, with a break in 2009:Q1. The dashed red line indicates the estimated average risk sensitivity before 2009:Q1. CBL is cross-border bank loans. IDS is international debt securities. The top two panels show advanced economies (OAEs; excluding safe havens), all borrowing sectors; the bottom two panels show emerging market economies (EMEs), all borrowing sectors. Units are the effect of a one-unit change in the logarithm of VIX on the growth rate of cross-border loans, international debt securities, or of the aggregated liquidity positions from the borrowing country perspective.

What Drives Time Variation in Risk Sensitivities?

The risk sensitivity of global liquidity flows is likely to be stronger when financial intermediaries are more leveraged or need more capital and consequently face greater balance sheet constraints. In the case of cross-border lending, this is because bank capital acts as a buffer against shocks and dampens the impact of spikes in global risk aversion on bank lending. Similarly, if NBFIs are highly leveraged, they have smaller buffers against contingencies, and as a result, financing through IDS becomes more sensitive to fluctuations in global risk aversion.

The different risk sensitivities of CBL and IDS flows may be explained by borrowers migrating from CBL to IDS markets. As banks move away from serving riskier borrowers, the average riskiness of CBL borrowers is likely to decline. Meanwhile, the overall risk sensitivity of IDS issuance could also decline if the borrowers that migrate from CBL to IDS markets are less risky than pre-existing IDS issuers.

Results from our empirical tests confirm that the risk sensitivities of global liquidity are indeed related to the tightness of the balance-sheet constraints faced by internationally active banks and NBFIs and to the migration of risky borrowers between CBL and IDS markets. Higher bank capitalization levels are associated with lower risk sensitivity of CBL flows. And migration of financial flows to IDS has reduced the risk sensitivity of both CBL and IDS flows. Finally, responses to risk depend on specific exposures to NBFI types by country and time, as these types have very different leverage profiles. Indeed, we find that the post-GFC migration of borrowers from CBL to IDS markets was associated with lower global risk sensitivities of global liquidity flows, especially for EME borrowers.

Our results emphasize the importance of bank capital and NBFI leverage. We find that increasing the capitalization levels of lending banks by one standard deviation more than fully offsets the negative impact of global risk on AGL flows to OAE borrowers and decreases its impact on EME borrowers by roughly two-thirds. In addition, decreasing the leverage of NBFIs by one standard deviation reduces the global risk sensitivity of AGL flows by 60 percent for OAE borrowers and by 30 percent for EME borrowers. Finally, a one standard deviation increase in the IDS share reduces the global risk sensitivities of AGL flows by 25 percent for OAE borrowers and by 20 percent for EME borrowers.

Final Words

Our evidence shows that the post-GFC shifts in the composition of the main global liquidity components (cross-border bank loans and international bonds) and the tightness of the balance sheet constraints faced by financial institutions providing this financing are important drivers of the magnitude of global liquidity responses to risk conditions. These drivers evolved against the backdrop of tighter bank regulations and the still relatively loose regulatory framework for nonbank financial institutions.

An important implication of our findings is that some of the post-GFC dampening in the global risk sensitivity of aggregate global liquidity flows could reverse depending on the evolution of the balance sheet constraints faced by the financial institutions intermediating these flows.

Stefan Avdjiev is head of international finance in the Bank for International Settlements’ Monetary and Economic Department.

Linda S. Goldberg is a financial research advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Stefan Avdjiev and Linda S. Goldberg, “Financial Intermediaries and the Changing Risk Sensitivity of Global Liquidity Flows,” Federal Reserve Bank of New York Liberty Street Economics, June 26, 2025, https://libertystreeteconomics.newyorkfed.org/2025/06/financial-intermediaries-and-the-changing-risk-sensitivity-of-global-liquidity-flows/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).