Xbox Insider Release Notes – Alpha (2403.240219-1730)

Hey Xbox Insiders! We have a new Xbox Update Preview releasing to the Alpha ring today.

It’s important we note that some updates made to these preview OS builds include background improvements that ensure a quality and stable build for Xbox consoles. We will continue to post these release notes, even when the noticeable changes to the UI are minimal or behind the scenes, so you’re aware when updates are coming to your device.

Details can be found below!

System Update Details

- OS Version: XB_FLT_2403ZN\25398.3813.240219-1730

- Available: 2 p.m. PT – February 21, 2024

- Mandatory: 3 a.m. PT – February 22, 2024

Fixes Included

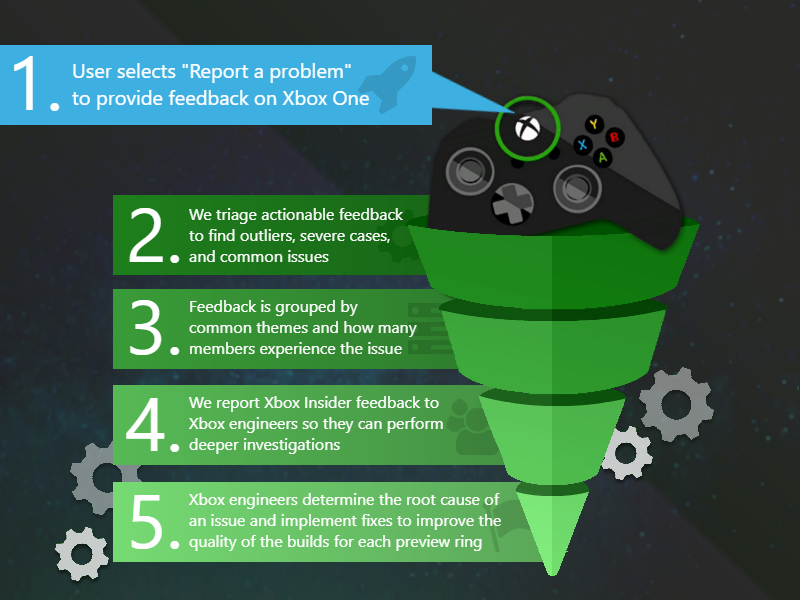

Thanks to all the great feedback Xbox Insiders provide and the hard work of Xbox engineers, we are happy to announce the following fixes have been implemented with this build:

Accessibility

- Fixes to improve narrator readout in the profile section in the guide.

System

- Various updates to properly reflect local languages across the console.

Known Issues

While known issues may have been listed in previous Xbox Insider Release Notes, they are not being ignored! However, it may take Xbox engineers more time to find a solution. If you experience any of these issues, we ask that you please follow any guidance provided and file feedback with Report a Problem.

Audio

- We have received reports of users experiencing intermittent issues with audio across the dashboard, games, and apps. If you have experienced issues, be sure you have the latest firmware updates for your TV and other equipment. If you’re unsure, you may need to contact the manufacturer for assistance.

- Note: If you continue to experience issues after applying the latest firmware updates, please submit feedback via Report a Problem immediately with the “Reproduce with advanced diagnostics” option, then select the category “Console experiences” and “Console Audio Output Issues”. Be sure to include as much information as possible:

- When did the issue start?

- Did you lose audio just in the game/app or system audio as well?

- Does changing the audio format resolve the issue? If yes, what was the format before and after?

- Does rebooting resolve the issue?

- What does your setup include? Equipment, layout, etc.

- And any additional information you can provide to reproduce the problem.

- Note: If you continue to experience issues after applying the latest firmware updates, please submit feedback via Report a Problem immediately with the “Reproduce with advanced diagnostics” option, then select the category “Console experiences” and “Console Audio Output Issues”. Be sure to include as much information as possible:

Networking

- We are investigating reports of an issue where the console may not connect to their network as expected on boot. If you experience this, be sure to report the issue via Report a Problem as soon as you’re able.

As always, be sure to use Report a problem to keep us informed of any issues you encounter. We may not be able to respond to everyone, but the data we’ll gather is crucial to finding a resolution.

If you’re an Xbox Insider looking for support, please visit the community subreddit. Official Xbox staff, moderators, and fellow Xbox Insiders are there to help with your concerns.

When posting to the subreddit, please look through the most recent posts to see if your issue has already been posted or addressed. We always recommend adding to existing threads with the same issue before posting a new one. This helps us support you the best we can! Also, don’t forget to use “Report a Problem” before posting – the information shared in both places helps us understand your issue better.

Thank you to every Xbox Insider in the subreddit today and welcome to the community if you’re just joining us! We love that it has become such a friendly and community-driven hub of conversation and support.

For more information regarding the Xbox Insider Program follow us on Twitter. Keep an eye on future Xbox Insider Release Notes for more information regarding your Xbox Update Preview ring!