Firms’ Inflation Expectations Have Picked Up

Editors note: Since this post was published, we clarified language in the first paragraph about year-ahead expectations for manufacturing and service firms in the 2025 survey. We also corrected the y-axis range of Chart 2. (March 5, 11 a.m.)

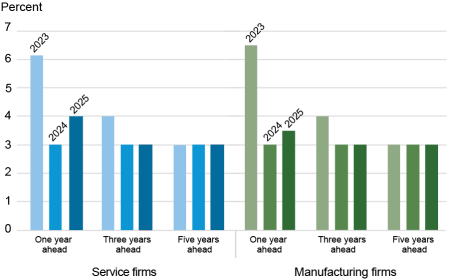

After a period of particularly high inflation following the pandemic recession, inflationary pressures have been moderating the past few years. Indeed, the inflation rate as measured by the consumer price index has come down from a peak of 9.1 percent in the summer of 2022 to 3 percent at the beginning of 2025. The New York Fed asked regional businesses about their own cost and price increases in February, as well as their expectations for future inflation. Service firms reported that business cost and selling price increases continued to moderate through 2024, while manufacturing firms reported some pickup in cost increases but not price increases. Looking ahead, firms expect both cost and price increases to move higher in 2025. Moreover, year-ahead inflation expectations have risen from 3 percent last year at this time to 3.5 among manufacturing firms and 4 percent among service firms, though longer-term inflation expectations remain anchored at around 3 percent.

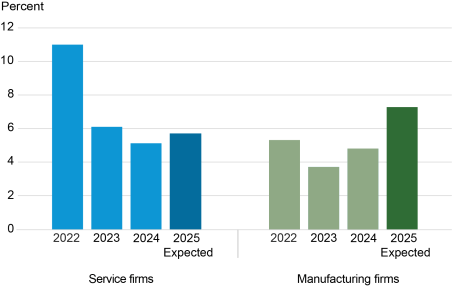

Business Costs Have Come Down, but That Trend Is Expected to Reverse

To gauge cost and price increases for regional businesses, the New York Fed’s February regional business surveys asked firms in the New York-Northern New Jersey region about past and expected changes in their business costs and selling prices, questions which we have also asked in prior years. The average annual cost increases reported over the past year in this year’s survey—covering cost increases in 2024—as well as in prior years’ surveys, are shown in the chart below.

Cost Increases Are Expected to Pick Up

Note: These averages represent a trimmed mean (the highest 5 percent and the lowest 5 percent of responses are excluded).

The average cost increase for service firms came down from 11 percent in 2022 to 6.1 percent in 2023 and fell further to 5.1 percent in 2024. For manufacturing firms, the average cost increase slowed from 5.3 percent in 2022 to 3.7 percent in 2023 but picked up to 4.8 percent in 2024. Indeed, there were significant cost increases for a number of inputs over the course of 2024 reported by manufacturing firms, including metals such as aluminum and copper, electricity and freight costs, as well as coffee and chocolate among food producers. Looking ahead, firms expect more significant cost increases in 2025. On average, service firms expect costs to rise at a 5.7 percent pace, while manufacturing firms expect cost increases to rise 2.5 percentage points to 7.3 percent.

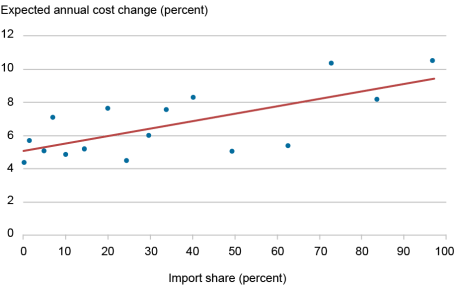

Imported Inputs Related to Higher Cost Expectations

This year’s surveys were in the field from February 3 to 12, a period during which several tariff announcements were made and then paused, with many firms reporting that they were uncertain but concerned about tariffs and their impact on costs. Indeed, higher cost expectations were related to the import share of firms’ inputs—a measure of potential exposure to tariffs. About 82 percent of service firms and 86 percent of manufacturing firms in the survey reported some use of imported inputs, which speaks to the globally integrated nature of firms in the U.S. economy. Below we present a binscatter visualization which plots the relationship between the share of inputs that firms import and expected cost increases in the year ahead.

Expected Cost Increases Are Higher Among Firms That Import More

A binscatter is essentially a scatterplot, where instead of plotting each individual response, responses are grouped into bins based on import share, and then plotted against the corresponding average expected cost increase for each bin. (For more on the methodology, see “On Binscatter” in Staff Reports; published also as Cattaneo et al. [2024]). The chart shows a positive relationship, meaning that firms with a higher import share expect steeper cost increases in the year ahead. Indeed, the chart indicates that expected cost increases for those with no imports would be about 5 percent, while those who import all of their inputs would expect cost increases of around 9 percent.

Selling Price Increases Also Expected to Pick Up

Parallel to cost increases, the chart below shows average annual price increases reported over the past year. Among service firms, the average annual price increase moved lower in both 2023 and 2024 but is expected to rise from about 4 percent to about 5 percent over the next year. Among manufacturing firms, the average annual reported price increase was 3.2 percent in both 2023 and 2024, but price increases are expected to rise by over 2 percentage points to 5.4 percent in 2025.

Price Increases Are Also Expected to Pick Up

Note: These averages represent a trimmed mean (the highest 5 percent and the lowest 5 percent of responses are excluded).

Higher Inflation Expected in the Year Ahead

With higher cost and price increases expected in the year ahead, expectations for overall inflation in the economy have also picked up relative to what was expected last year at this time, as shown in the chart below. Median year-ahead firm inflation expectations (based on the CPI) climbed from 3 percent in last February’s survey to 4 percent among service firms in this year’s survey, and from 3 percent to 3.5 percent among manufacturing firms, both of which are higher than the CPI inflation rate of 3 percent reported in January. Longer-run inflation expectations at both the three-year and five-year horizons in our business surveys have remained anchored at 3 percent, both this year and last year. An increase in year-ahead inflation expectations in February has also been reported among consumers in both the University of Michigan’s Survey of Consumers and the Conference Board. The New York Fed’s Survey of Consumer Expectations will report its February data in early March but inflation expectations had generally held steady through January 2025.

Temporary or Persistent?

Overall, our February business surveys showed a pickup in cost and price expectations for 2025, as well as year-ahead inflation expectations. Tariffs were clearly on the mind of many businesses. However, longer-term firm inflation expectations remained anchored at 3 percent, the same as firms were expecting last year at this time. More survey data on inflation expectations in the months ahead will help clarify whether higher expectations are just temporary or more persistent.

Chart Data and Full Survey Results ![]()

Jaison R. Abel is head of Microeconomics in the Federal Reserve Bank of New York’s Research and Statistics Group.

Richard Deitz is an economic policy advisor in the Federal Reserve Bank of New York’s Research and Statistics Group.

Ben Hyman is a research economist in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post:

Jaison R. Abel, Richard Deitz, and Ben Hyman, “Firms’ Inflation Expectations Have Picked Up,” Federal Reserve Bank of New York Liberty Street Economics, March 5, 2025, https://libertystreeteconomics.newyorkfed.org/2025/03/firms-inflation-expectations-have-picked-up/.

Disclaimer

The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).