NYCB’s stock continues its slide despite an analyst’s vote of confidence

Wall Street’s negative sentiment around New York Community Bancorp continued Monday even as an analyst reiterated a buy rating on the stock and said its business remains strong enough to handle expected loan risk.

The ratings actions around New York Community Bancorp’s stock

NYCB,

remained mixed, however, as Moody’s Investors Service issued its second debt downgrade on the bank in about a month.

New York Community Bancorp’s stock fell 11.4% to $3.15 on Monday.

Janney stock analyst Christopher Marinac said the bank has more loss capacity to handle any loan stress than investors understand.

“There is sufficient loss coverage from existing PPNR (pre tax pre provision revenues) or operating cash flow to recognize problem credits and incur loan loss write-offs,” Marinac said Monday.

Marinac said New York Community Bancorp has a $2.04 billion loss severity forecast from 2024 to 2026, with combined reserves, provision charges, and residual pre-provision net revenue (PPNR) after paying dividends of $2.97 billion, Marinac said.

“This enables substantial loss capacity and problem loan recognition by the company,” he said.

The bank’s available capacity to recognize credit problems and absorb credit losses on its own with existing reserves and PPNR or operating cash flow “should enable the company to raise additional capital to position the company for future success,” Marinac said.

The bank is preparing to file its financial information with a remedy for internal control weaknesses and should enable a real understanding of actual criticized loans, he said.

“We feel the company could raise ‘comfort capital’ to increase its …regulatory ratio,” he said.

In its downgrade late Friday, Moody’s analysts said the bank faces the possibility of rising provisions for credit losses and higher funding costs, which would “complicate the bank’s ability to organically raise capital.”

Moody’s downgraded all long-term and some short-term ratings and assessments of New York Community Bancorp

NYCB,

further into junk territory, after the bank said it had “material weaknesses” in its accounting protocols and said it would delay its financial filings.

Flagstar Bank, NA, the operating business of holding company New York Community Bancorp, was downgraded to Ba3 from Baa2, lowering it from investment-grade to speculative-grade, or junk, status.

Moody’s said the company’s Feb. 29 disclosures “are further signals…that it is undergoing substantial changes in governance, oversight, risk management and internal controls” during a “particularly challenging” operating environment which includes risks in its loan portfolio.

The bank’s challenges may also “negatively affect” confidence among depositors and investors, Moody’s said.

“Moody’s believes that NYCB may have to further increase its provisions for credit losses over the next two years because of credit risk on its office loans, and that there is substantial repricing risk on its multifamily loans,” analysts said.

The bank also faces higher funding costs on its interest-bearing liabilities due to higher-for-longer interest rates expected in 2024.

The bank now faces $3.4 billion of multifamily loans maturing in 2024 and $5.1 billion of loans maturing in 2025, Moody’s said. It has about $18.3 billion in multifamily loans to rent-regulated apartments on its balance sheet.

The risk-weights on seasoned multifamily loans could rise to 150% from 50% if the loans become non-performing, Moody’s said.

A non-performing loan (NPL) is defined as borrowed money whose scheduled payments have not been made by the debtor for a period of time, usually 90 or 180 days.

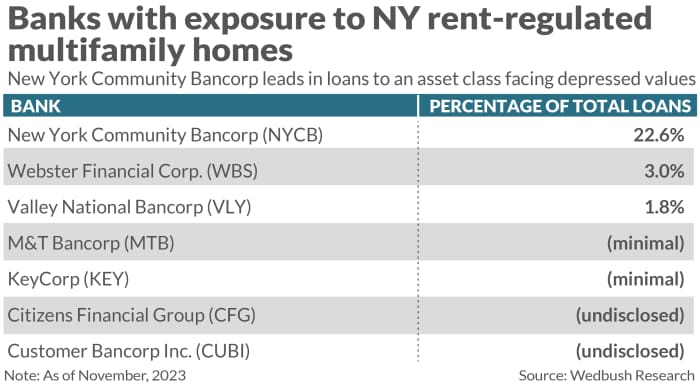

New York Community Bancorp, the parent of Flagstar bank, faces a higher percentage of total loans to rent-controlled multifamily homes

MarketWatch/Terrence Horan

The U.S. Supreme Court on Feb. 20 declined to hear challenges to New York’s rent stabilization laws, Moody’s said. Those laws have prevented landlords from raising rents to help combat the impact of higher interest rates.

The case stemmed from 2019’s Housing Stability and Tenant Protection Act, which was crafted to create more affordable housing. It also changed rules that had allowed landlords to increase rents on rent-controlled multifamily units.

Since then, property expenses have been growing due to inflation, putting pressure on net operating income and stressing debt-service coverage ratios, Moody’s said.

New York Community Bancorp’s and Flagstar’s bonds continued falling on Monday on the heels of its latest disclosures, as the following chart from data solutions provider BondCliQ Media Services shows.

Bond prices for NY Community Bancorp and its Flagstar unit both fell Monday but have not tested their recent lows.

BondCliQ Media Services

Moody’s said the bank also faces $313 million of office loans maturing in 2024 and $237 million in 2025. About 54% of the bank’s office loans are in Manhattan, which currently has a vacancy rate of about 15%, Moody’s said.

The risk weights on office loans that become non-performing would rise to 150% from 100%.

The rating cut by Moody’s move comes about a month after it downgraded NYCB’s ratings to junk territory, on the heels of the bank’s surprise loss that crushed its stock price.

On the positive side for the bank, on Friday it named a new chief risk officer as well as a chief audit executive.

Also read: New York Community Bancorp ‘is on its own’ to work out accounting mess, analyst says

Philip van Doorn contributed.