This Super Artificial Intelligence (AI) Stock Could Be at the Beginning of a Terrific Bull Run

Investors have been buying artificial intelligence (AI) stocks hand over fist, which helps explain why shares of Cloudflare (NYSE: NET) have shot up an impressive 40% in the past three months. And the company’s latest quarterly results suggest that its red-hot rally is here to stay.

Cloudflare stock shot up 20% the day after it released its fourth-quarter and full-year 2023 results on Feb. 8. Investors liked the company’s better-than-expected numbers and the solid outlook that points to robust growth ahead.

Let’s take a closer look at Cloudflare’s latest results and see how AI is having a positive impact on the company’s growth.

Cloudflare customers are spending more money on its solutions

Cloudflare’s fourth-quarter revenue increased 32% year over year to $362 million, exceeding the consensus estimate of $353 million. The company’s full-year revenue was up 32% to $1.3 billion.

Cloudflare’s adjusted earnings saw a significant jump as well, increasing from $0.06 per share in the year-ago period to $0.15 per share, and exceeding the $0.12 per share consensus estimate. Full-year earnings increased to $0.49 per share from $0.13 in 2022.

Cloudflare, which provides cloud-based internet infrastructure services that speed up internet connections while improving performance, security, and reliability, delivered stronger-than-expected growth thanks to robust customer spending, as well as an increase in its customer base.

Cloudflare ended the fourth quarter of 2023 with 189,000 paying customers, up 16% from the year-ago period. However, it is worth noting that Cloudflare gets more than 60% of its top line from large customers who have generated more than $100,000 in annualized revenue for the company. The company finished 2023 with 2,756 of these large customers, an increase of 35% over the prior year.

What’s more, the number of customers with annualized revenue of more than $500,000 increased at an even faster pace of 56%. There was a nice year-over-year jump of 39% in the number of customers with annualized revenue of more than $1 million.

Cloudflare serves a massive addressable market, which it expects to be worth $164 billion in 2024 and then grow to $204 billion in 2026. The company points out that AI presents an incremental growth opportunity, and it has already started gaining impressive traction in this market.

A closer look at the AI opportunity

In September 2023, Cloudflare launched Workers AI, a platform that allows developers to build AI applications on its network without having to invest in expensive infrastructure. Workers AI gives customers access to graphics processing units (GPUs) on Cloudflare’s network so that developers can “run well-known AI models on serverless GPUs” and “build and deploy ambitious AI applications that run near your users, wherever they are.”

These models allow developers to run various models meant for text generation, automatic speech recognition, image classification, and translation. Workers AI has gained terrific traction among Cloudflare customers. On its latest earnings conference call last week, CEO Matthew Prince said:

From our launch in September to the month of December, the average number of daily Workers AI requests increased 9x. Furthermore, one-third of the thousands of Workers AI accounts are new to the Workers platform, suggesting that Workers AI is not just [a] significant opportunity in and of itself, but also a potential accelerant to [the] adoption of the Workers overall platform.

It won’t be surprising to see this platform witnessing stronger adoption. By the end of 2023, Cloudflare had deployed GPUs in 120 cities, exceeding its target of 100 cities. Even better, the company aims to have “inference-tuned GPUs deployed in nearly every city that makes up Cloudflare’s global network and within milliseconds of nearly every device connected to the internet worldwide.”

Given that Cloudflare’s global network covers 300 cities, the company’s aim to deploy AI GPUs across its vast network could help it capitalize on the fast-growing AI-as-a-service market.

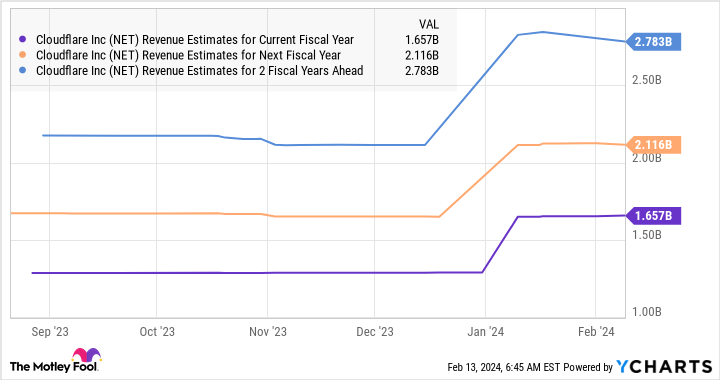

So, Cloudflare is pulling the right strings to make the most of this fast-growing niche, and this could help the company maintain its solid growth. Not surprisingly, Cloudflare expects its revenue in 2024 to jump 27% to $1.65 billion. Analysts are expecting the company to sustain its robust growth in the coming years.

What’s more, the company’s bottom line is expected to increase at an annual rate of 62% for the next five years. Based on its 2023 earnings of $0.49 per share, Cloudflare’s bottom line could jump to $5.47 per share after five years using that compound annual growth rate. Multiplying that by the Nasdaq-100 index’s forward price-to-earnings multiple of 30 (using the index as a proxy for tech stocks), would put Cloudflare’s stock price at $164 in five years. That would be a 60% increase from current levels. This is why I’m excited about this stock.

Should you invest $1,000 in Cloudflare right now?

Before you buy stock in Cloudflare, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cloudflare wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cloudflare. The Motley Fool has a disclosure policy.

This Super Artificial Intelligence (AI) Stock Could Be at the Beginning of a Terrific Bull Run was originally published by The Motley Fool